During these very trying times, it is important to stay healthy, happy and productive. Yes, the world is basically on fire right now and there seems like very little that you can do about it.

Safety First

The most important thing right now is that you do take the situation seriously. This means avoiding all social interactions as much as possible. If you do not need to leave the house, then don’t! If you must leave the house, then take as many precautions as possible. Keep a safe distance of at least six feet. Wear a mask at all times, this is very critical, it does not matter if it is an official mask or a homemade one, each is better than not having a mask. You should consider wearing gloves. By keeping six feet away it goes without saying that you should not be shaking anybody’s hands or kissing anyone’s cheeks, unless they form part of your home base. Wash your hands as often as possible and avoid habits of touching your face with your hands. If you have glasses wear them, this is not a time for contact lenses.

It is most critical to stay safe. If you are not sure what is safe and what is not safe, please go online and find out or send us a note and we will find the answer for you.

Staying Positive

It is important to stay positive during these hard times. It is great if you can communicate with your friends on social media and even get together on Skype or Zoom. These are both excellent tools to have a group chat and stay in touch. We recently used Zoom to have a family get together and the system worked perfectly. You can see all the people there at once and hear everyone. The system does not lag.

It is also a great time to take up a new hobby or to exercise or do both. You should focus on your health during this period as well. Exercise helps you to have a stronger immune system which cannot hurt during this period. As well, eating the right foods will go a long way to ensure that you can stay healthy. While these measures are good, remember the best by far remains social distancing. Eating a good diet and exercise can no way replace social distancing right now. Don’t get these two confused.

Investing during this Pandemic

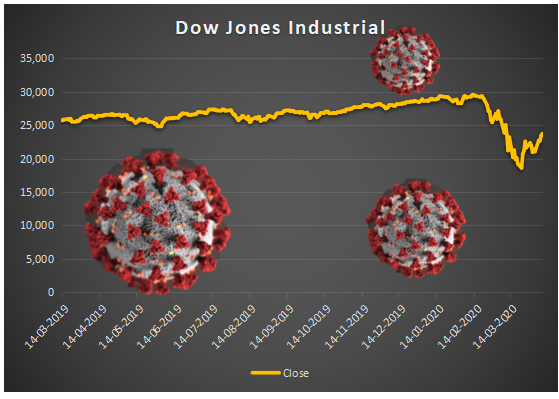

If you have been following the stock markets, you would have seen a sharp decline in stock prices, see chart below. One can see a sharp decline in prices during the latter part of March, they a now making a comeback but not fully back to the point during March.

The stock prices for the Dow Jones Industrial average went from a high of almost $30,000, on March 23rd, 2020, the prices dropped to close at $18,591, while on February 19th, 2020, the price was at $29,348 – this represents approximately a 37% loss of value in just over a one month period. As at April 9th, 2020, the prices have regained value to $23,719. This recouped a lot of what was lost but there is still a long way to go.

Possible Scenarios

There are many possible scenarios for the next few weeks and months to come. Each of these possibilities will play a role on what strategy one should take.

If the situation improves and people slowly go back to work, this would be the ideal situation on many aspects, with the assumption that the COVID-19 situation is truly under control. If this were to be the case, it is very likely that the stock prices will rebound to their original point or near that point. Hence, a good strategy here would be to invest more. Hence, buying would be what would be called for.

If the situation remains much the same and people remain at home, this will mean a greater slow down in the market and this will have a negative effect on the market. It would likely drop further either to the lowest point on March 23rd or perhaps even further. If this were the case, the right strategy now would be to sell.

The third possibility is that things get much worse, this will increase people not going to work and an increased level of unemployment will mean that the economy will be worse and as a result, the stock prices will fall and will fall even greater than before. In this case, the proper strategy would be to wait or to sell.

Here is a chart showing the Dow Jones industrial since 1985, you can see the sharp decline in the 2008 – 2009 period, this was a very significant decline, but it did bounce back over some years.

Various Strategies

The strategies are dependent on your current situation are you heavily invested or do you carry more cash? If you are 90% or more invested, then the strategy would be to sell, if the situation remains the same or gets worse. If you are less invested, let’s say 10%, then you should not buy on the poor situations and definitely buy on the positive scenario, the first scenario would be the situation where you would buy.

The challenge here is that with each possibility there is some risk. If you feel that the situation will improve and thus you increase your portfolio or do not decrease it, then if the situation worsens, your portfolio takes a hit. If you assume things will get worse and you sell, then if things improve you also have a loss or you have missed a potential gain. What about taking a hybrid approach. Let us say that you are 90% in, then if you sell half your position today, so that you are 45% in, then if the stocks drop, you can buy more at the lower price, thus earning a gain on this drop. This would be better than leaving all in. If things improve, well, you are still earning on that 45% that you still have in your portfolio, so in a sense you are still gaining, although, you did lose another potential gain. In this case, you are hedging your situation, if things drop, you can purchase more and if things rise, you are still significantly earn to earn an increase in the prices rising.

Most of the stock markets saw a very similar trend, here is the trend for QQQ, an Index fund of Nasdaq. You can see a very similar trend, with a large decrease by late March and then some recovery one month later.

At this point, no one has a crystal ball, there are good arguments to make that the prices will continue to rise and there are other arguments to make for the stock prices to continue to fall. This approach allows you to make profits either way, you will gain if stocks fall, as you sold a significant portion and you will gain if stocks rise as you still have a significant stake.

There is one caveat with this strategy and that is if the stock prices continue to fall indefinitely then the strategy will be in a difficult position, although this has never occurred and will likely never occur, but it is definitely something to consider. Hence, it is still a risk but one that is worth taking. (Speaking about risks- please see disclaimer).

What if…

As the stocks fall, you should plan to buy, then as the stocks rise you should plan to sell. You could set up a limit that says, if the stocks fall by 5%, then, I will purchase 10% more shares at this lower price and continue to do so, hence, if the stock price falls 15%, you would have picked up 30% more shares at a reduced price. Now, if the stocks start to rise, you can hold on or start to sell your shares at a profit, only sell 10% when the price increases by 5%, as well. This process will earn you money for each downturn and upswing. Hence, if the stocks drop by 5%, let us say you invest 10% of your cash in that position, let us say your cash position is $10 M. Whatever your balance is the percentage gains or losses will remain the same. You now invest $1 M on shares at a discount of 5%, if in a week, those shares climb back up 5% and you sell, you will have gained 5% on your $1 M investment or $ 50 K. Now, let us say those shares decreased by 15%, now you have invested $3 M and should they go back to the original starting point, you would have earned 5% of $3 M or $150 K. This strategy is good when dealing with indexes or a large group of shares, do not use this strategy on one individual stock, there is too much risk with putting all your eggs in one basket.

Risks provide Opportunities

Investing during this pandemic of COVID-19 is definitely fraught with risk but also with possibilities for gains. It is important to keep calm and do not react too quickly or overreact. I believe that Warren Buffett said, “Widespread fear is your friend as an investor because it serves up bargain purchases.” this may be very true today. He also says this about his general strategy, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” These are golden rules and should always be applied. In short, when people are scared and selling the prices will drop, this is the period to start buying, conversely, when people are optimistic and starting to buy, this will drive up prices and this is the time to sell, once the prices have risen above a certain value. It is critical that you ensure that you are getting more value than the price that you are paying, by sticking to this principle, you will do well, as Warren Buffett has done very well.

Where does this leave us?

Well, the reality is that there is definitely some opportunity now, so the time is to plan this out correctly, use a strategy where you invest in index funds so that all of your eggs are not in one basket, decide at what point you want to be invested right now. If you are unsure, aim for about 50%, this way you can get further gains if the stocks falls and you can ensure that you take part of the gains should the stocks bounce back. If you are sure that the stocks will fall more, then obviously your strategy would be to sell more today and buy more after a significant decline in stock prices. If you are sure that they are going to rise, then you would increase the percentage of your investment. It is important to understand that it is extremely difficult to know absolutely if the stocks will go up tomorrow or go down tomorrow. If this was known or knowable, it would already be reflected into the prices of the shares. Keep this in mind when anyone is telling you whether to buy or not to buy. The one thing that is clear is that there will be quite a bit of turbulence over the next few weeks and months so invest cautiously and wisely. Try to avoid doing what the masses are doing and try to remain calm, this will pay dividends down the road, quite literally.

Final Conclusion

Remember that your safety is the most important commodity that you have and worth more than your portfolio is worth. With these turbulent times the most important thing is to react calmly when it comes to your investments, by remaining calm you will have a big advantage over the majority of shareholders. Think like Warren Buffett thinks and if in doubt, think of investing in BRK-A or BRK-B. These turbulent times present an opportunity, it is important that you arrange your portfolio in the best way to capitalize on this situation. Hence, the best investment strategy during COVID-19 is to remain calm and understand that this may be a good time to start increasing your investments.

To get more information on investing during this pandemic and beyond speak with our team at Green Bridge Consulting : Click here

To read about personal finances find all you need to know about personal finances at this link: Click here

To join our Facebook Page : Click here

Disclaimer – We take no responsibility for any gains or loss that you may incur by following or not following the advice. The very nature of investing is risky and those risks should be understood, losses and gains are inevitable, one must understand how to hedge their risk and only invest what you have that is potentially there to lose. Feel free to get in touch with the author or make an appointment to understand more about investing and what risks there are.